For more than 15 years, MetaTrader 4 is one of the most sought-after trading platforms of this generation. Its user-friendly interface, magnificent features, and versatility attract millions of traders all over the world. Due to its demand, almost all Forex brokers offer it to their clients. It’s actually hard to find a broker that doesn’t offer this trading platform. Its huge success is just unbelievable. What could be the secret? If there are benefits, does it also have vulnerabilities? If there are then you deserve to know these things.

MetaTrader, both 4 and 5, has gained a reputation as the ultimate choice of traders, both newbies, and experienced ones. There are so many ways to learn about MT4. Some online forums and articles discuss the proper use of this trading platform. Nonetheless, we are going to tackle the strengths and their downsides here.

Basic Features of MetaTrader 4

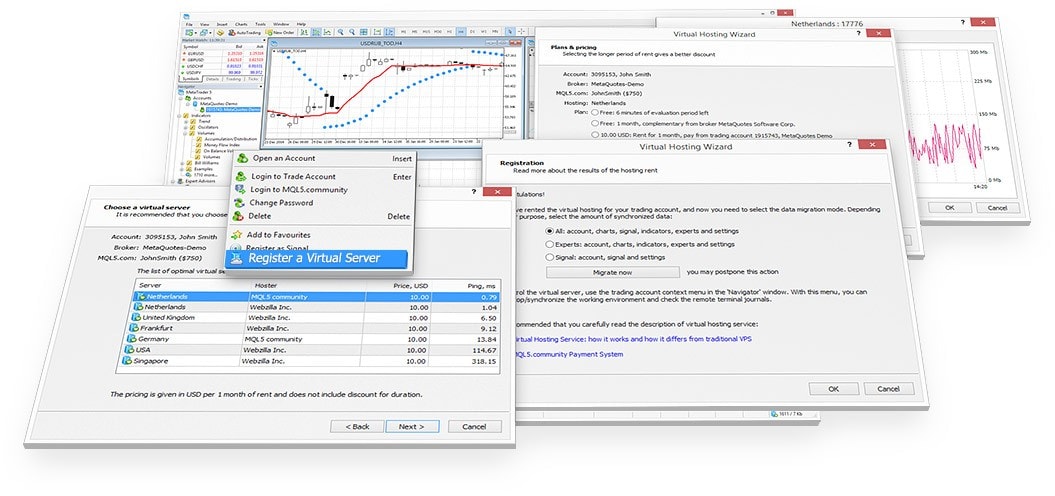

MT4 is a trading platform that can be accessed either through your desktop software, mobile application, and web-based platform. These are the three ways to connect with the MT4 trading platform. As traders connect with these servers, data is also being shared simultaneously. This allows users to switch from one device to another throughout the day. Moreover, this trading platform also supports more than 30 languages and can be downloaded for both Android OS and iOS devices.

The MT4 terminal also displays the market quotes and even allows advanced operations. Traders can also install the technical tool Expert Advisors which is an automated system that makes decisions instead of them through a series of commands set by the trader. MT4 also supports copy trading.

If you think there’s nothing more left to offer, then you are thinking wrong. MetaTrader 4 is customizable. If you are a techy user and you have the capacity to automate your trades and use your own technical indicators, then you can do so in MT4. Some of the charting features include 24 graphic objects, 9 timeframes, and 30 embedded indicators.

There are three ways to execute a trade. It can either be an instant execution, execution by market, and execution on request. For market orders, it is concluded immediately based on the current price while pending orders are only finalized on a price level that’s predefined. Users can also choose to use stop-loss pending orders, limit orders, and stop orders.

What Are The Vulnerabilities?

It is true that MT4 is quite popular even after so many years. However, it is said that there are issues experienced by Mac users. The installation of this trading platform requires them to have 200 MB memory and this is too cumbersome on their side. They also have to do some extra work by installing additional funds on their system.

As you’ve already known, MetaQuotes already released a more updated trading platform, the MetaTrader 5. It is also gaining popularity especially for traders who want to venture into other markets such as stocks and commodities. So, if you are asking which trading platform to choose, it is better to assess your needs first before coming up with a decision. No one will know the most-suited trading platform for you rather than yourself.